Ten years into my product management career, I realized I’m still not well-versed in the financial aspects of a company and how to calculate the financial viability of a project.

Understanding a company’s quarterly results and interpreting them is crucial. Most of the projects I work on, unless they involve a new product line, do not measure financial results. Instead, we focus more on adoption, customer VOC, analytics, NPS, etc. That’s probably why I didn’t bother to learn the financial aspects of my projects.

In this article, I will summarize the key aspects of finance that every product manager should be aware of. This is no substitute for a finance course, but it will provide a high-level overview of the numbers you should look for in confusing and complex financial statements.

The purpose of my article is to explain key financial concepts in plain English and highlight a few important figures rather than overwhelming you with a barrage of numbers.

How to understand a company's financial position

Let's break down the key financial statements of a company. There are three main ones you'll need to understand.

- Balance sheet

- Income statement

- Cashflow statement

I have taken an example of the company Meta for this exercise.

Figure 1: Balance sheet of Meta

How to read a balance sheet

The numbers that are most important in the balance sheet are:

Total assets:

Definition: Total assets represent the sum of everything the company owns and controls that has economic value.

Importance: This number provides a comprehensive view of the company’s resources and is crucial for evaluating the overall size and financial strength of the company.

Total liabilities:

Definition: Total liabilities are the sum of all financial obligations and debts the company owes to external parties.

Importance: This figure is essential for understanding the company’s financial obligations and assessing its leverage and financial risk.

Shareholders' equity

Definition: Shareholders' equity is the residual interest in the assets of the company after deducting liabilities. It represents the owners' claim on the company’s assets.

Importance: This number indicates the net worth of the company from the shareholders' perspective and is a critical measure of financial health. It’s also used to calculate important ratios like Return on Equity (ROE).

These three numbers form the core equation of the balance sheet:

Understanding these three figures provides a fundamental insight into the financial position of a company, including its resources, obligations, and the value attributable to its owners.

How to read an income statement

Now let us understand the income statement of Meta.

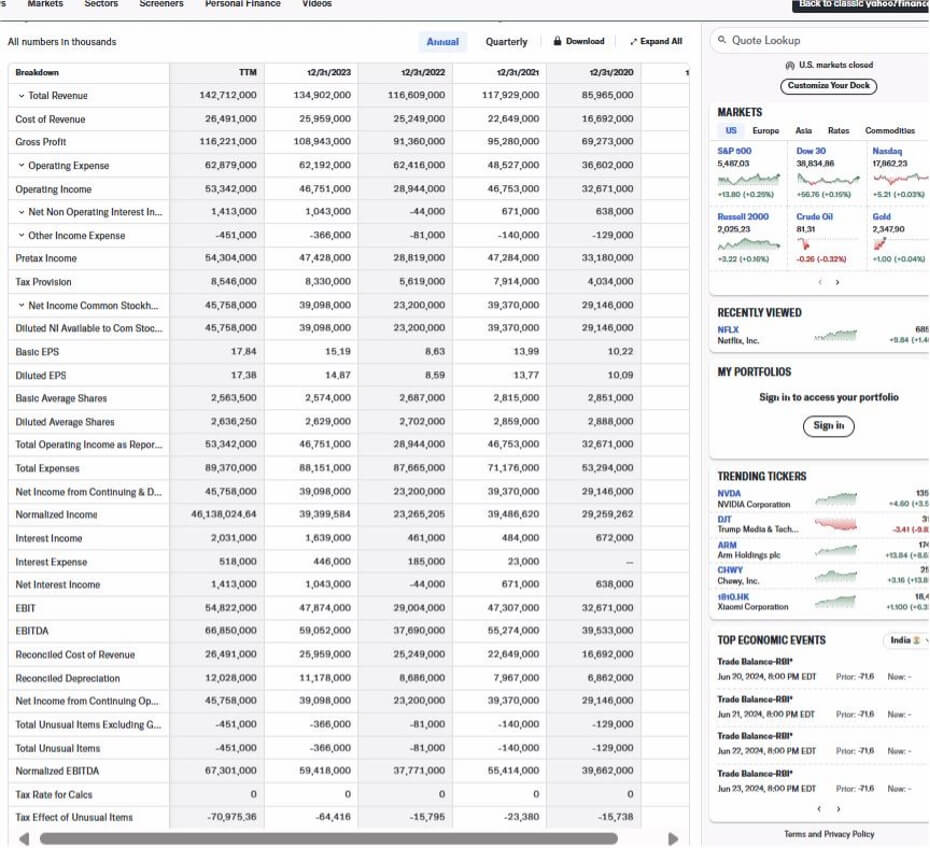

Figure 2: Meta income statement

Revenue (or Sales)

- Definition: The total amount of money generated from the sale of goods or services.

- Importance: This is the top line of the income statement and indicates the company’s ability to generate sales. It provides a clear picture of the company’s market demand and growth potential.

Operating income (or Operating profit or EBIT)

- Definition: Gross profit minus operating expenses (which include selling, general, and administrative expenses).

- Importance: This number shows the profitability of the company’s core business operations before interest and taxes. It is a key indicator of operational efficiency and the company's ability to manage its costs relative to its revenue.

Net income (or Net profit)

- Definition: The total profit of the company after all expenses, including operating expenses, interest, taxes, and any other expenses, have been deducted from total revenue.

- Importance: Net income is the bottom line of the income statement and indicates the overall profitability of the company. It reflects the company’s ability to generate profit for its shareholders and is crucial for assessing the company’s financial health and performance.

These three numbers provide a comprehensive view of a company’s financial performance, from its ability to generate sales, to its efficiency in managing operations, to its overall profitability.

How to read a cash flow statement

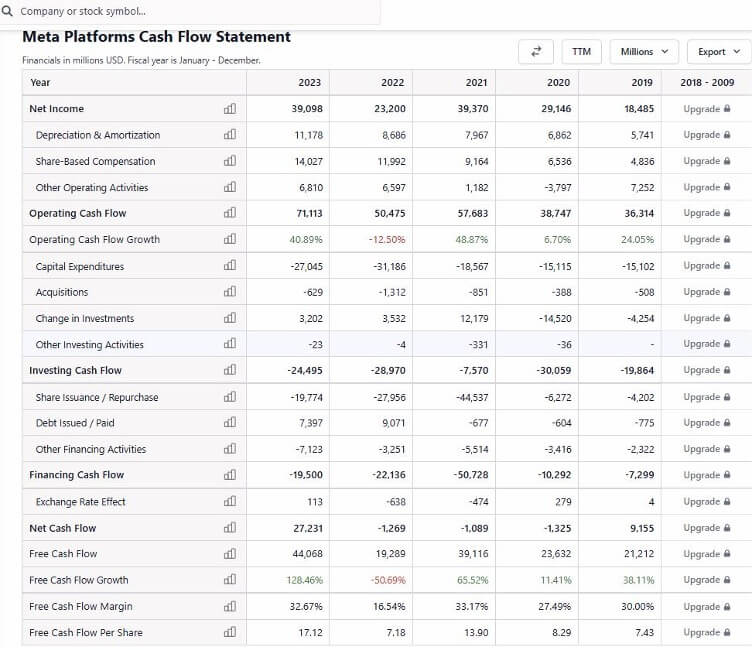

Let's look at the Cash Flow Statement of Meta.

The top three critical numbers in a cash flow statement are:

Net cash provided by operating activities

a. Definition: The total cash generated from the company’s core business operations. This figure adjusts net income for non-cash items like depreciation and changes in working capital (e.g., accounts receivable, accounts payable).

b. Importance: This number indicates the company's ability to generate sufficient cash flow from its regular business activities to sustain operations, pay debts, and invest in growth. It is a key measure of a company's financial health and operational efficiency.

Net cash used in investing activities

a. Definition: The total cash used for investing in the company’s long-term assets, such as purchasing property, plant, and equipment (PP&E), or investments in other businesses. This figure also includes cash inflows from the sale of these assets.

b. Importance: This number shows how much the company is investing in its future growth and development. High levels of investment can indicate expansion and long-term growth prospects, but they also require substantial cash outflows.

Net cash provided by (or used in) financing activities

a. Definition: The total cash received from or used in activities related to financing the company, such as issuing or repurchasing stock, borrowing or repaying debt, and paying dividends.

b. Importance: This number reflects the company’s capital structure decisions and its ability to raise funds to support operations and growth. Positive cash flow from financing activities can indicate successful capital raising, while negative cash flow might indicate debt repayment or dividend distribution.

These three numbers provide a comprehensive view of how a company generates cash, where it is investing for the future, and how it manages its financing. Understanding these figures is crucial for assessing the company’s liquidity, financial flexibility, and overall financial health.

Other financial terms you need to know

- EBITDA: Stands for Earnings Before Interest, Taxes, Depreciation, and Amortization, which is an alternate measure of profitability to net income.

EBITDA = Net income + taxes + interest expense + D&A

Or EBITDA = Operating income + D&A

Where D&A = Depreciation and Amortization

The earnings (net income), tax, and interest figures are found on the income statement, while the depreciation and amortization figures are normally found in the notes to operating profit or on the cash flow statement.

- EPS (Earnings Per Share)

EPS = total earnings / outstanding shares

Earnings per share (EPS) is the most commonly used metric to describe a company's profitability.

It shows how much profit can be generated per share of stock and is calculated by dividing earnings by outstanding shares.

In simple terms, it's the amount of profit that each stock in the company “owns.” If all the company's profits were distributed to shareholders, this is how much you would get for each share you own.

You can find total earnings, which is the same as net income, and the number of outstanding shares on a company's income statement.

So, for Meta the EPS is 45.6 billion/2.5 billion = 18.01$

- Amortization: Amortization is a method of spreading an intangible asset's cost over the course of its useful life. Intangible assets are non-physical assets that are essential to a company, such as a trademark, patent, copyright, or franchise agreement.

- Assets: Assets are items you own that can provide future benefits to your business, such as cash, inventory, real estate, office equipment, or accounts receivable, which are payments due to a company by its customers. There are different types of assets, including:

- Current assets: Can be converted to cash within a year

- Fixed assets: Can’t immediately be turned into cash but are tangible items that a company owns and uses to generate long-term income

- Asset allocation: Asset allocation refers to how you choose to spread your money across different investment types, also known as asset classes.

- Capital gain: A capital gain is an increase in the value of an asset or investment above the price you initially paid for it. If you sell the asset for less than the original purchase price, that would be considered a capital loss

- Capital market: This is a market where buyers and sellers engage in the trade of financial assets, including stocks and bonds.

- Cash flow: Cash flow refers to the net balance of cash moving in and out of a business at a specific point in time.

- Compound interest: This refers to “interest on interest.” Rather, when you’re investing or saving, compound interest is earned on the amount you deposited, plus any interest you’ve accumulated over time. While it can grow your savings, it can also increase your debt; compound interest is charged on the initial amount you were loaned, as well as the expenses added to your outstanding balance over time.

- Depreciation: Depreciation represents the decrease in an asset’s value. It’s a term commonly used in accounting and shows how much of an asset’s value a business has used over a period of time.

- Equity: Equity, often called shareholders’ equity or owners’ equity on a balance sheet, represents the amount of money that belongs to the owners of a business after all assets and liabilities have been accounted for. Using the accounting equation, shareholder’s equity can be found by subtracting total liabilities from total assets.

- Liabilities: The opposite of assets, liabilities are what you owe other parties, such as bank debt, wages, and money due to suppliers, also known as accounts payable. There are different types of liabilities, including:

- Current liabilities: Also known as short-term liabilities, these are what’s due in the next year.

- Long-term liabilities: These are financial obligations not due over a year that can be paid off over a longer period of time.

- Liquidity: Liquidity describes how quickly your assets can be converted into cash. Because of that, cash is the most liquid asset. The least liquid assets are items like real estate or land because they can take weeks or months to sell.

- Net Worth: You can calculate net worth by subtracting what you own, your assets, with what you owe, your liabilities. The remaining number can help you determine the overall state of your financial health.

- Profit Margin: Profit margin is a measure of profitability that’s calculated by dividing the net income by revenue or the net profit by sales. Companies often analyze two types of profit margins:

- Gross Profit Margin: Typically applies to a specific product or line item rather than an entire business

- Net Profit Margin: Typically represents the profitability of an entire company

- Return on Investment (ROI): Return on Investment is a simple calculation used to determine the expected return of a project or activity in comparison to the cost of the investment, typically shown as a percentage. This measure is often used to evaluate whether a project will be worthwhile for a business to pursue. ROI is calculated using the following equation: ROI = [(Income - Cost) / Cost] * 100

- Valuation: Valuation is the process of determining the current worth of an asset, company, or liability. There are a variety of ways you can value a business, but regularly repeating the process is helpful because you’re then ready if ever faced with an opportunity to merge or sell your company or are trying to seek funding from outside investors

- Working Capital: Also known as net working capital, this is the difference between a company’s current assets and current liabilities. Working capital—the money available for daily operations—can help determine an organization’s operational efficiency and short-term financial health..

Understanding the financials behind funding projects

The second piece of the puzzle that product managers should know is how to finance innovation. When embarking on a new project, they need to calculate the financial implications, determine when they will break even, and estimate when they will start making a profit.

Even the best and most innovative ideas will go nowhere unless you can convince others to commit the necessary resources. Doing so almost always requires making a compelling case that the value of the opportunity far outweighs the upfront costs.

We will go in depth of following calculations:

- The difference between earnings and cash flows

- Measuring value using NPV

- IRR

- DCF/WACC valuation models

Net Present Value method

Let us now shift gears to how we can decide whether investing in a project is profitable or not. The first method of evaluation is calculating the Net Present Value (NPV). While there are complex formulas to calculate NPV, many online calculators make it easy for you.

If you are trying to assess whether a particular investment will bring you profit in the long term, this NPV calculator is a tool for you. Based on your initial investment and consecutive cash flows, it will determine the profitability of a planned project.

Let's analyze the following example: a company has to choose between two projects that both cost $10,000 to implement. Each of them will last for 5 years, but they have different expected cash inflows. The discount rate is 5% in each case. Which project should the company choose?

|

Time |

Project 1 |

Project 2 |

|

Initial

investment |

$10,000 |

$10,000 |

|

Year 1 |

$5000 |

$1000 |

|

Year 2 |

-$1000 |

$1000 |

|

Year 3 |

$3000 |

$1000 |

|

Year 4 |

$3000 |

$5000 |

|

Year 5 |

$2000 |

$4000 |

|

|

|

|

If you use the NPV calculator mentioned in the link above to determine the NPV for each of these projects, you will discover that the NPV of project 1 is equal to $481.55, while the NPV of project 2 is equal to –$29.13.

This result means that project 1 is profitable because it has a positive NPV. Project 2 is not profitable for the company, as it has a negative NPV. That is why the company should choose to implement project 1.

*The discount rate is the interest rate that banks pay the Federal Reserve to borrow money for short-term loans.

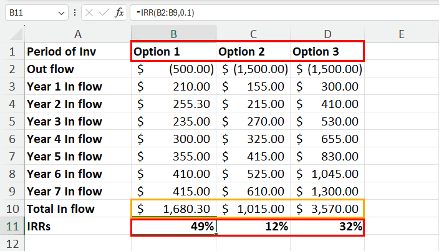

Internal Rate of Return method

The internal rate of return (IRR) is a another commonly used metric to estimate the profitability of a potential investment. Sometimes, it is also referred to as discounted cash flow rate of return or economic rate of return.

To calculate the Internal Rate of Return (IRR) in Excel, you can use the IRR function. Here's how:

- Enter your cash flow data into a column or row.

Year 1:

A1: -1000

A2: 200

A3: 300

A4: 400

A5: 500

where -1000 is the initial investment.

- Select the cell where you want the result to appear.

- Type “=IRR (range of cash flows), [guess]”.

- Excel will automatically calculate the IRR and display the result as a percentage.

In the IRR formula, “guess” is an optional argument that represents a number guessed by the user that is close to the expected internal rate of return. However, if you use it, Excel can generate better results when not used.

You can’t just decide where to invest considering the IRR values of different projects. You also need to look at the total return the project is generating, the stability of the project, and many more.

For example, the above dataset compares three investment projects. Here’s a simple analysis of the data:

- Option 1: Fetching a return of $1,680.30 at an IRR of 49%.

- Option 2: Giving a return of $1,015.00 at an IRR of 12%.

- Option 3: Generating a total income of $3,570.00 at an IRR of 32%.

You should definitely avoid Option 2 since it doesn’t generate enough returns for you.

Option 1 does show a whopping 49% IRR but the accumulated return is nominal, $1,680.30 after 7 years of investment.

There are also variations of IRR called XIRR, MIRR.

Discounted Cash Flows method

Using Discounted Cashflows, investors can use the concept of the present value of money to determine whether the future cash flows of an investment or project are greater than the value of the initial investment. To conduct a DCF analysis, an investor must make estimates about future cash flows and the ending value of the investment, equipment, or other assets.

The investor must also determine an appropriate discount rate. If the investor cannot estimate future cash flows or the project is very complex, DCF will not have much value and alternative models should be employed.

The formula for DCF is

DCF = CF1/(1+r)1 + CF2/(1+r)2+…CFn/(1+r)n

Where

CF1 = The cash flow for year 1

CF2 = The cash flow for year 2

CFn = The cash flow for additional years

r = Discount Rate

When a company analyzes whether it should invest in a certain project or purchase new equipment, it usually uses its weighted average cost of capital (WACC) as the discount rate to evaluate the DCF. The WACC incorporates the average rate of return that shareholders in the firm are expecting for the given year.

For example, say that your company wants to launch a project. The company's WACC* is 5%. That means that you will use 5% as your discount rate.

*WACC stands for Weighted Average Cost of Capital. It's a key financial metric that represents the average cost of capital a company uses to finance its operations. In simpler terms, it's the minimum return a company expects to pay to its investors (both debt and equity holders) to fund its activities.

The initial investment is $11 million, and the project will last for five years, with the following estimated cash flows per year.

|

Cash Flow |

|

|

Year |

Cash Flow |

|

1 |

$1 million |

|

2 |

$1 million |

|

3 |

$4 million |

|

4 |

$4 million |

|

5 |

$6 million |

Using the DCF formula, the calculated discounted cash flows for the project are as follows.

|

Discounted Cash Flow |

||

|

Year |

Cash Flow |

Discounted Cash Flow (nearest

$) |

|

1 |

$1 million |

$952,381 |

|

2 |

$1 million |

$907,029 |

|

3 |

$4 million |

$3,455,350 |

|

4 |

$4 million |

$3,290,810 |

|

5 |

$6 million |

$4,701,157 |

|

|

|

|

Adding up all of the discounted cash flows results in a value of $13,306,727. By subtracting the initial investment of $11 million from that value, we get a net present value (NPV) of $2,306,727.

The positive number of $2,306,727 indicates that the project could generate a return higher than the initial cost—a positive return on the investment. Therefore, the project may be worth making.

If the project had cost $14 million, the NPV would have been -$693,272. That would indicate that the project cost would be more than the projected return. Thus, it might not be worth making.

Using the above methods, product managers can also add a financial aspect to the projects they want to kick-start. Having financials can help PMs demonstrate to senior management that they have gone above and beyond to determine if a project is profitable for the company to invest in.

In my articles, I always suggest taking some more courses that make fundamentals solid.

These are the courses I found:

Free courses

Coursera: Financial Management for Product Leaders | Coursera

Stanford Online: Explore | Stanford Online

Paid courses:

Stanford Online: Product Costing Course | Stanford Online

That’s the article on product managers and the basics they should know on finance. I’ll see you soon in the third part of the series - PMs and UX

The quest for innovative strategies to captivate, retain, and convert users into loyal customers never stops. Luckily, there's a game-changing approach that's been taking the business world by storm: Product-Led Growth (PLG) Conversion.

If you want to unlock sustainable growth, increase revenue, and build a thriving user base, you've come to the right place - we've got an ebook that will be your ultimate guide.

Follow us on LinkedIn

Follow us on LinkedIn