Oftentimes, companies discount the price of their products to drive sales; in fact, research conducted in recent years has confirmed discounting is the top pricing strategy for retailers across all sectors.

Although discounting your product can increase your customer base and generate additional income, there are also times when this method can be counterproductive; the strategy can reduce your profit margins or attract negative personas.

Conversely, there are some instances when it’s necessary to raise the price of your product. While it may seem like a risky tactic, there are ways in which you can introduce new pricing parameters without alienating customers and increasing churn rates.

In this article, we’ll discuss:

- Things to consider when raising prices

- How to calculate the elasticity of demand

- Expert pricing advice

- How to improve your pricing knowledge

Things to consider when raising prices

Whether you’re raising the price of an established product, or amending the cost of a relatively new offering, it’s important to remember you’re not bucking the trend - it isn’t uncommon for companies to reevaluate their costs. However, there are important things to consider if you decide to raise your prices.

Offer value to your customers

Put yourself in the shoes of your customers and ask yourself: if pricing increased, would you expect more, the same, or less?

If you’re bumping up the costs for your customers, you need to give them something extra in return - undoubted value needs to be attributed to your increase.

The acid test? If a customer contacted you and demanded to know why they’re paying more, you should be able to say unequivocally, “following our price increase, you’re getting X, Y, Z.” Offer no doubts or uncertainty as to what they stand to receive in return.

Use introductory pricing

Introductory pricing does exactly what it says on the tin: it’s an initial price point that’s used by a company to establish a market share. Prices are then increased when the product has established itself in the field.

Also referred to as a ‘first-time special offer’, introductory pricing is an effective way to increase pricing as its unambiguous nature sets customer expectations. I.e. ‘the product price is temporary, and is subject to change.’

Therefore, when the time does come to raise the price, your customers can’t say they weren’t given a prior warning - the signs were there in black and white, all along.

Offer current price lock-in

If your product is in constant phases of development and introducing a breadth of brand-new features, pricing will inevitably increase.

Let’s use a hypothetical example involving Apple, in which the company enters the video game market and releases a console to rival Sony and Microsoft.

Initially, the product may accommodate three core features that users would come to expect from a console: offline gaming, internet access, and online gaming.

However, six months down the line, imagine Apple announcing a pioneering addition to its pay-monthly, live gaming feature that isn’t provided by Playstation and Xbox.

In this case, the product would have a distinguishable USP, giving the company reasonable cause to raise the price for monthly subscriptions. After all, gamers wouldn’t be able to experience Apple’s cutting-edge technology elsewhere - it’s a market exclusive.

This is where the current price lock-in comes into play. Apple could offer existing users the option of ‘locking in’ to the current price plan for a prolonged period, and in return, the customer’s protected from the hike in price - they can enjoy the new feature at the same price.

Be decisive

The best product marketers have the courage of their convictions to make important decisions, and the decision to raise product prices isn’t to be taken lightly.

When you’re making changes to your price, there’s a fine line between being decisive and being reckless. So, before you implement any drastic changes, conduct your research and establish how much you can raise your prices.

If you overestimate how much your customer is willing to pay, you could well find yourself trying to reactivate churned customers, which is no easy feat.

Be honest

Customers buy products from companies they know, like, and trust.

If one of these three principles is damaged, your relationship with the customer can be tarnished. If they feel as though they don’t know you and can’t identify with your brand, they won’t like you. And if they like you, they won’t trust you.

Honesty is one of the most important qualities in business. Without it, you’re setting yourself up for failure, and the same applies when you’re raising your pricing. Be upfront, leave no questions asked, and tell them why the change has been made.

Just remember: lying to your customers and making empty promises about what’s coming their way never worked for anybody. If they’re told the hike has been introduced to fund a new, non-existent feature, rest assured, they’ll find out they’ve been tricked sooner or later.

Gradually increase prices

It isn’t uncommon for companies to raise the cost of their products in one fell swoop, but again, put yourself in the shoes of the customer to understand how this can be problematic for your user/subscriber.

For example, a customer may sign up for a budget gym for $30 per month. Then, the gymnasium may open a state-of-the-art swimming pool, steam room, and sauna, prompting the club to increase membership prices to $50 per month, to cover the costs.

While access to premium facilities for an additional $20 is reasonable, the price increase may be too much for a member to pay straight away. Instead, the impact can be lessened by increasing the price for existing memberships at a gradual rate across three months:

- After month one, the membership could increase to $40,

- After month two, membership could increase to $45, and

- After month three, the membership will be set at the new rate of $50.

The incremental increase allows the customer to realign their budget to accommodate the new costs of their membership and improves customer retention.

Apply astute pricing strategies

The slightest price increase can prompt a customer to run a mile - but you can keep them on board by pricing shrewdly.

For example, if your company sells apparel to local sports teams and a 10-pack of shorts retails for $100 but you need to raise the price to $120, the additional $20 could initially be deemed as an unreasonable raise by your customer.

However, if you create different-sized packages, such as a five-pack for $70, this makes the ten-pack seem like a preferable option, even at the new, higher price.

Improve your product/service

It’s fair to say that nobody wants to pay more money for something that hasn’t changed at all. But if the product/service has been improved, you have justification for increasing the price from the offset.

For example, let’s say a customer is paying $50 per month for their cable TV subscription. Their package includes sixty channels, twenty of which are gated sports and movie channels.

The cable TV provider wants to increase the monthly subscription to $70 per month and they have two options:

- Offer the same amount of channels at an increased price, or

- Increase the price but give their customers access to sports and movie channels.

The first option holds no appeal for the customer; they’re being asked to pay more money, with no incentive. However, while the second option is more expensive, the overall service is better; they receive premium channels as part of their updated subscription.

Offer discounts

When your prices increase, you can’t keep every single one of your customers happy, particularly customers who are more economically minded.

While a degree of customer churn is inevitable, you can improve your customer retention by introducing discounts to your customers to negate the price increase.

Your customers with one eye on their spending will be more than happy to use a discount code, while customers who aren’t necessarily too fussed about a slight price increase will pay your new price anyway. Either way, a significant proportion of your customers will be paying full price.

How to calculate the elasticity of demand

When you’re increasing your price you need to take into account the elasticity of demand.

The elasticity of demand is used to determine how a price change can have an impact on consumer demand and can be calculated using the following formula:

% Change in Quantity ÷ % Change in Price = Price elasticity of demand.

In many cases, buyers remain unperturbed, even if prices increase. For example, if the price of milk increased by 10%, the likelihood is shoppers would continue to purchase the product.

Other products, however, suffer when their price increases. These are known as elastic goods. For example, if the price of Coca-Cola significantly increased, there are other, cheaper sodas available on the market and consumers may buy an alternative.

This is something that you need to consider when you’re increasing the price of your product: would an increase drive customers to a rival? Or, are they loyal enough to stick with your brand?

Expert pricing advice

We spoke with Phill Agnew, Senior Product Marketer at Hotjar, who outlined two tactics PMMs can use to increase their product prices: hyperbolic discounting and the decoy effect.

Hyperbolic discounting

Hyperbolic discounting is a fancy phrase for something we all know. It's that feeling when you have a mountain of work piling up, and you know you need to get it done within the next couple of days but you just can't find the motivation to do it.

You put it off and instead watch Netflix and convince yourself that tomorrow you'll get all that work done. In that scenario, you have fallen victim to something called hyperbolic discounting:

“Hyperbolic discounting refers to the tendency for people to increasingly choose smaller, immediate rewards over larger later rewards.”

The problem here? Instant gratification.

Hyperbolic discounting is a cognitive bias where people choose smaller immediate rewards, so watching Netflix and feeling a bit of satisfaction, rather than larger rewards in the future, essentially getting all that work done and feeling real relief.

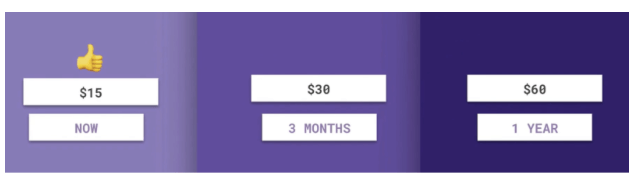

Here’s an example of hyperbolic discounting in action:

In the right scenario, if we were all smart, rational consumers, we would all take the $60 - that's worth the most and it's the best package we could get. But most of us pick the $15 now because the satisfaction of gaining something quickly and immediately beats having to wait a year.

Interestingly, when consumers were asked the same question with the same intervals, but a year later, they tended to choose the largest $60 reward.

This proves that we’re impatient and prefer immediate, short-term rewards.

For individuals, this creates a lot of problems - like not saving for retirement - but one of the ways that you can get around this is by breaking down big goals into smaller, more manageable chunks.

The problem with things like saving for retirement is that saving’s a huge challenge; the amount an American needs to save is about $1.7 million for their retirement. Saving that much takes a lot of money and almost a lifetime to achieve. With huge goals like that, it's much better to break it down into smaller tasks with a reward coming after each chunk.

That way, the reward’s no longer a distant possibility, but something that’s more immediate and guaranteed. This works not just for people trying to save for retirement, but for big brands and product marketers who are trying to justify their high prices.

Let's pretend you're selling a high-value Mercedes Benz, you could show the full cost for $40,000 today, or you could show the cost broken down perhaps by using a bit of hyperbolic discounting insight.

You could say it's broken down to $32 per week, or $4.75 a day over two years, but which would look most attractive to the user?

One study analyzed this to reveal conclusively which was seen as the most attractive price. The researchers presented one of three numbers at random to over 500 participants and the results revealed the shorter the time frame, the smaller the cost, and the more appealing the deal.

When the prices were shown as daily figures, they were five times more likely to be rated as a great deal than when they were shown annually. For SaaS marketers and product marketers, this is a really interesting insight.

Where possible in the future, we should pursue the extra bill and push the cost of paying off into the future; we shouldn't encourage consumers to spend thousands now - instead, we should get them to make smaller commitments, like $4 a day.

That's one way you can reframe your products to push for a higher price. It works because you have to remove that immediate pain of payment. But it's not the only way you can reframe your price.

The decoy effect

The decoy effect is used by a lot of Saas marketers, but it’s not necessarily a technique a lot of people particularly understand.

Example one: Popcorn

To explain the decoy effect, I'll give a bit of a story about myself.

Every time I go and watch a movie, I buy a ridiculously large amount of popcorn, and after the movie, I always regret how much I've eaten. I'm usually full after a couple of handfuls, but I always plow through to the bottom and finish the box.

Next time I go, I'll do it again. I keep getting into a habitual loop and I feel awful every time, but I can't get out of it. But now when looking at the price of popcorn, I start to realize why I keep falling into this trap.

These are the actual prices of popcorn at my local cinema in London. There's something really interesting about them, right?

The extra-large is too much - £7 (about $10 in America). That's almost the price of the actual cinema ticket.

I'd never spend that much but the next option down, which is just 50p more than the smallest option, at £4, looks like a much better deal. With this pricing, I can't help but pick this middle option. The reason it looks like such a good deal is due to the decoy effect.

Example two: The Economist

Let me further explain the decoy effect by bringing in the famous study which was cited by Dan Ariely in his book, Predictably Irrational.

So Dan, being a professor at Princeton University, spotted the decoy effect, not in the cinema, but while flicking through The Economist.

He found that The Economist had these three pricing options that they were publishing. They had the online-only subscription at the top ($59), the print-only subscription ($125), and then the print and web subscription ($125).

That's quite weird, right? With this third option, you get both the print and online versions, but it's the same price as the print option by itself.

Why would anyone buy the print-only option? After all, it's the same price as the print and web options.

Dan predicted that The Economist was using this strange pricing strategy to create a decoy and encourage more consumers to spend $125, rather than the $59 for the online-only subscription.

To test this hypothesis, Dan tried it out on his students. He showed one set of his students the actual pricing with the decoy included, and the other set of students an edited version with the decoy - the print-only option - removed.

He wanted to see if removing the decoy price changed what people thought about the product and changed what people wanted to buy. Turns out removing that decoy had a huge effect.

When students were shown the decoy effect option, which was the one that The Economist had on their site, they would, on average, pick the most expensive print and web subscription, it looks like such a good deal, because it was the same price as the print subscription and yet it had the web subscription included as well.

Yet, when Dan showed his students the edited version, without the print subscription included, suddenly students were far more likely to pick the online subscribers only. The majority of students only spent $59.

This is an interesting discovery. Just the way that The Economist has priced their products, the way they frame their pricing, the way they’ve built their options, dramatically changes what consumers want.

Whether you’re putting a strategy in place, discounting a product, or increasing costs, pricing plays a prevalent role for any product marketer - it’s critical to understand the ins and outs of the area.

How to improve your pricing knowledge

To raise costs effectively, you need to understand the intricacies of the area.

After all, pricing can make or break your product - set the bar too high, and you’ll price your customers out of the market, but set your price point too low, and you’re running the risk of undermining the quality of your product.

For successful product-led growth, being able to create immense customer value is the name of the game. But without the tools to effectively capture this value, your product can end up short-changed and your company’s growth can grind to a halt.

This is where our Product-Led Pricing Masters course comes in.

Learn how to approach a monetization strategy that works, understand the fundamentals of a product-led motion and the basics of monetization. Expertly apply specialized principles that help develop an effective monetization strategy, and more.

Follow us on LinkedIn

Follow us on LinkedIn