Product and Strategy are two of the most overused and over-concentrated words floating in the industry for quite some time and rightly so.

I get to use both in my day job as well as in my side projects within the industry. Owing to my inclination and experience in financial technology, I would like to touch upon the same as a case to understand the product strategy around it.

The classical definition as per Wikipedia – “Financial technology (abbreviated fintech or FinTech) is the technology and innovation that aims to compete with traditional financial methods in the delivery of financial services” outlines the subtlety between current and traditional forms of technology as an enabler in the delivery of financial offerings.

Fintech in its evolutionary form has been championed by technology start-ups, up-starts, and early adopters whereas traditional institutions though late to the party are catching up rapidly; owing to their user base, capital influx, regulatory practices, and mammoth experience in the financial industry. Internet adoption and developer mindset are two of the important factors that drove the current state of fintech adoption.

Strategy on the other hand has been prevalent since the time of military tactics by Greeks. American Professor Richard P. Rumelt described strategy as a type of problem-solving in 2011, that has an underlying structure called - kernel. The kernel has three parts:

1) A diagnosis that defines or explains the nature of the challenge;

2) A guiding policy for dealing with the challenge; and

3) Coherent actions designed to carry out the guiding policy

Let us now apply the strategy definition to fintech products and see where it takes us.

Fintech Products + Strategy

FinTechs rely heavily on technology as an equal participant to enable the financial products which challenge the traditional approach of financial services being decision driven first and technology acting as an infrastructure rather than a key driver. To enable the shift in ecosystem and understanding the challenge in doing so, strategy acts as the kernel bringing innovative challengers to shake the status quo. A good strategy relies on a data-driven approach to define the nature of the market, customer, and product features and is inherently quantifiable thereby making tangible fintech products and offerings. Let’s see how these strategic movements are pushing the envelope in a new-age post smartphone world.

Pushing the envelope

As per numerous industry reports and statistics, FinTech products draw some of the big-ticket investments globally, almost to the tune of half the overall venture capital investments. The question that might surprise us is – Where is all this investment going into? Which geographies make the most of the pie? Which Fintech products move the needle? Well, the answer to all the above can be found in numerous reports, insight papers, investor fillings, etc but the common theme for me in all of those would be a strategic drive and intent to command such an audience and capital. The strategy to understand the end consumer, the products in play, the addressable market, and the unique selling potential drives the metrics thereby attracting some of the viable funding, acknowledgment, and customer satisfaction.

What is the differentiator?

As per Angela Strange from Andreessen Horowitz – “Every company will be a Fintech company”.

So, what is the differentiator then and what strategies are pivotal in staying relevant when you are clouded by technology giants like Amazon, Apple, Google, Facebook, Uber, etc and financial giants such as JP Morgan, Barclays, Goldman Sachs, etc. The answer might not be in challenging the enormous technology prowess and reach that these firms possess but in understanding the customer segment to target, the market nuances one is delving into, and the simplicity of feature consumption. This technique can be applied more or less to all forms of product offerings under the sun.

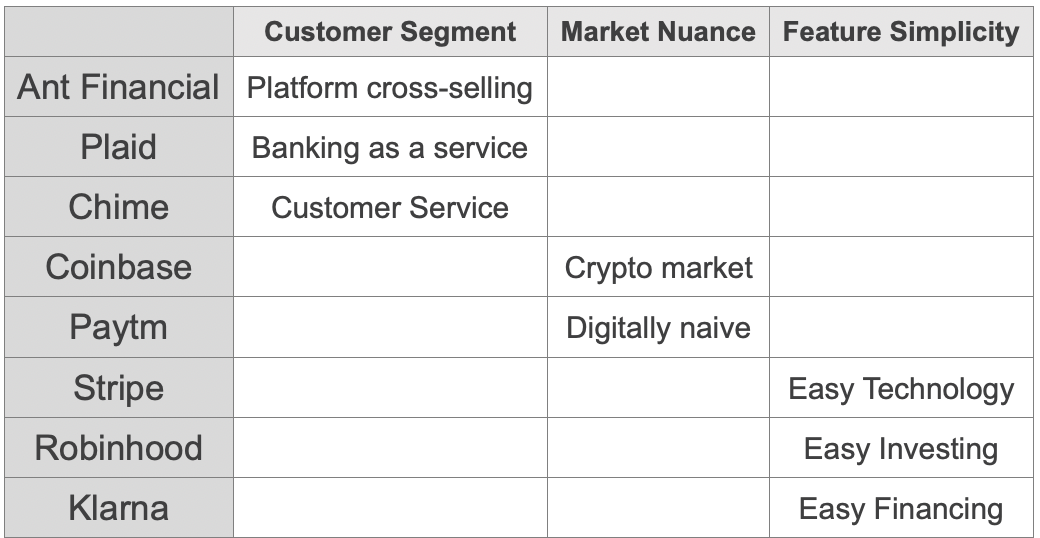

To give context, some of the biggest players in recent times in terms of users and investments in financial services are FinTech products offered by the likes of Ant Financial, Stripe, Coinbase, Robinhood, Plaid, Chime, Adyen, Klarna, Paytm, and others. Applying the above theory of at least one key differentiator in understanding the product strategy offering to some of the examples below can drive the point:

If we look at the above matrix, some of the most sticky and widely adopted products followed a data-driven strategy of understanding what I would call the 3 key pillars:

Customer Segment

- Ant financial formulated the strategy to cross-sell services using unified platforms across segments. (Application Segmentation)

- Plaid made it quite easy for financial firms to integrate banking as a service for their end-users. (Platform Segmentation)

- Chime and many other digital banks harnessed their offerings to the customers disappointed by mega retail banks (User Segmentation)

Market Nuance

- Paytm capitalized on the demonetization initiative in India and targeted a massive digitally naive population into financial inclusion. (Digital second market)

- Coinbase took the strategic approach in identifying cryptocurrency especially bitcoin offering as a nuanced market. (Early mover market)

Feature Simplicity

- Robinhood made investing in stocks and financial instruments as easy as ordering items on Amazon. (Knowledge Simplification with UI/UX)

- Klarna made the ‘buy now pay later’ lending model a modern phenomenon. (Journey Simplification championing customer centricity around buying)

- Stripe’s success was their ease of integration using fewer and simple lines of codes (Developer advocacy simplification)

Is it just the product strategy then?

The global developments we are part of now considering the pandemic, the geopolitical influences, and a new generation of challenges, product strategy can but do so much to influence growth and revenue. Product-based/led Strategy for me has always been a tool to Problem definition first rather than Solution finding and this is what would drive the understanding around key decisions in product offerings (Fintechs, Insurtechs, Adtechs, Edutechs, etc) which has been outlined above – Customer, Market & Feature. The evolution of banks relied heavily on solution finding rather than the problem definition and to be fair, banks had their own challenges in using technologies best suited for those times. The cost centers of yesteryears are being turned into technology profit drivers of today. What is helping that?

Certainly, a good product strategy is in understanding the problem first around the customer adoption, market intricacies, and feature enhancements and then pacing towards the solution.

To finish with a quote that I use quite loosely – “Technology evolution is faster than human evolution and the smarter we strategize the product offering the better are our chances”.

Follow us on LinkedIn

Follow us on LinkedIn